Brands and Marketing

Despite Headwinds Zenith Bank’s Profit After Tax Rises By 5% In Q1 2021

In a clear demonstration of its resilience, Zenith Bank Plc on Friday announced its unaudited results for the first quarter ended 31st March 2021, with Profit After Tax (PAT) rising by 5 percent to N53.1 billion, from N50.5 billion recorded in March 2020.

OnyxNews Nigeria reports that this is even with a very challenging macroeconomic environment aggravated by the COVID-19 pandemic.

From the unaudited statement of account presented to the Nigerian Stock Exchange (NSE) on Friday, the Group’s Profit Before Tax (PBT) also grew by 4 percent, from N58.8 billion to N61.0 billion in the same period.

The profitability was driven by the optimisation of the cost of funds and improvement in non-interest income. The bank’s cost of funds reduced significantly from 2.6 percent in March 2020 to 1.1 percent in March 2021.

This was also reflected in interest expense which dropped by 45 percent from N32.8 billion to N18.0 billion over the same period. Non-interest income increased by 10 percent from N46.6 billion to N51.2 billion, driven by growth in credit-related fees and fees on electronic products.

READ How To Block Your Bank Account And SIM Card In Case Of Emergency

Non-interest income was boosted by the increase in fees and commission income, which resulted from the increased volume of transactions across all the bank’s channels.

Cost of risk dropped from 0.6 percent in March 2020 to 0.5 percent in March 2021, which affirms the bank’s prudent risk management, even as gross loans increased by 2 percent from N2.92 trillion to N2.98 trillion in Q1 2021.

The bank’s robust customer acquisition strategy and the effectiveness of its electronic platforms and digital channels enabled it to deliver a N54 billion increment in the savings account balance, which is solely retail.

Customer deposits increased by 6 percent from N5.34 trillion in December 2020 to N5.68 trillion in March 2021. Transactions on electronic channels also grew astoundingly as new customers continue to be attracted to the bank’s various user-friendly digital platforms.

Going forward in 2021, the bank expects that the ongoing economic recovery and improvements in the yield environment will translate into improved numbers for the Group. This is expected to be supported by local and international COVID-19 vaccination campaigns, rising commodity prices, and global economic growth of up to 6 percent, as estimated by the International Monetary Fund (IMF).

SEE ALSO: FG Commences Payment Of 500K To Beneficiaries Of ESP Survival Fund, See When

The Group will continue to position itself to take advantage of positive developments in the domestic and global economy to deliver improved financial performance and returns to all its stakeholders.

-

Entertainment1 week ago

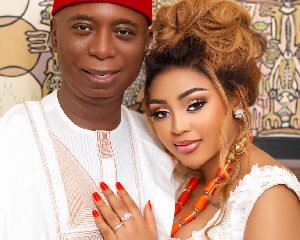

Entertainment1 week agoVideo: See What Ned Nwoko Did To Tiktoker Who Claimed His Wife, Regina Daniels Has A Boyfriend In Abuja, Sowore Slams

-

Crime3 days ago

Crime3 days agoBREAKING: Nigerian Man Arrested in U.S. Over Massive Fraud Scheme Targeting Veterans’ Health Organization(PHOTO)

-

Education3 days ago

Education3 days agoBREAKING: Lagos Launches Bold Move to Control Private and Mission Schools – New Policy to Shake Up Education Sector

-

Entertainment1 week ago

Entertainment1 week agoSony Music Signs Famous Gospel Singer, Shola Allyson

-

Headline1 week ago

Headline1 week agoPresident Tinubu Vows Justice for Plateau Wedding Guests Killed in Attack

-

Crime4 days ago

Crime4 days agoBREAKING: Popular Nigerian Gospel Singer Sentenced To Death By Hanging

-

Headline4 days ago

Headline4 days agoSenate Appoints Chibudom Nwuche, As Chairman Of South-South Development Commission

-

Headline4 days ago

Headline4 days agoHIJRAH 1447AH: Osun, Jigawa Govts Declare Friday Public Holiday

-

Headline1 week ago

Headline1 week ago2027 Election: APC Faces Internal Power Struggle Over Shettima’s Vice Presidential Role

-

Entertainment1 week ago

Entertainment1 week ago[VIDEO]: Nollywood Actor Femi Branch Denied Leaving Access After Assaulting Crew Member