Brands and Marketing

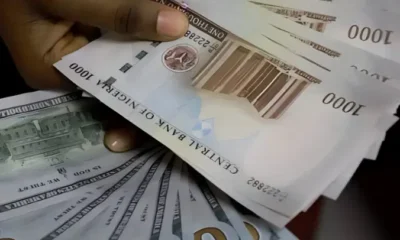

CBN To Restrict Bank Accounts Without NIN, BVN From April

CBN To Restrict Bank Accounts Without NIN, BVN From April

The Central Bank of Nigeria (CBN) has issued a circular stating that bank accounts without a Bank Verification Number (BVN) or National Identification Number (NIN) will be frozen starting from April 2024.

The circular, jointly signed by CBN Director, Payment System Management Department, Chibuzo Efobi, and Director, Financial Policy and Regulation Department, Haruna Mustapha, emphasizes the need for customers to ensure that their accounts/wallets are linked to a valid BVN or NIN.

To facilitate this, the CBN has set a deadline for the electronic revalidation of BVN or NIN, which is January 31, 2024.

This means that individuals with accounts or wallets lacking proper BVN or NIN credentials have until this date to update their information.

The circular reads: “Effective March 1, 2024, all funded accounts or wallets shall be placed on Post No Debit or Credit and no further transactions permitted.”

Furthermore, the CBN has declared that, going forward, no new Tier 1 accounts or wallets will be opened without BVN or NIN verification.

“It is mandatory for ALL Tier-1 bank accounts and wallets for individuals to have BVN and/or NIN, it said, adding that “it remains mandatory for Tiers 2 and 3 accounts and wallets for individual accounts to have BVN and NIN.”

In addition, the CBN has announced its intention to conduct a comprehensive audit of BVN and NIN records. The purpose of this audit is to identify any breaches or non-compliant accounts.

Any account found to be in violation of the BVN and NIN policy will face appropriate sanctions.

It is important for individuals who hold bank accounts in Nigeria to take immediate action to ensure that their BVN or NIN is associated with their accounts.

This will help avoid any disruption or freezing of their accounts starting from April 2024.

Compliance with this directive is crucial to ensure the smooth operation of the banking system and to promote financial transparency and accountability.

-

Entertainment1 week ago

Entertainment1 week agoVideo: See What Ned Nwoko Did To Tiktoker Who Claimed His Wife, Regina Daniels Has A Boyfriend In Abuja, Sowore Slams

-

Crime5 days ago

Crime5 days agoBREAKING: Nigerian Man Arrested in U.S. Over Massive Fraud Scheme Targeting Veterans’ Health Organization(PHOTO)

-

Education5 days ago

Education5 days agoBREAKING: Lagos Launches Bold Move to Control Private and Mission Schools – New Policy to Shake Up Education Sector

-

Headline6 days ago

Headline6 days agoSenate Appoints Chibudom Nwuche, As Chairman Of South-South Development Commission

-

Crime6 days ago

Crime6 days agoBREAKING: Popular Nigerian Gospel Singer Sentenced To Death By Hanging

-

Headline6 days ago

Headline6 days agoHIJRAH 1447AH: Osun, Jigawa Govts Declare Friday Public Holiday

-

Headline1 week ago

Headline1 week agoPresident Tinubu Vows Justice for Plateau Wedding Guests Killed in Attack

-

Education5 days ago

Education5 days agoOutrage in Ibadan: Students, Alumni Kick Against Renaming of Ibadan Polytechnic After Late Governor Olunloyo

-

Entertainment1 week ago

Entertainment1 week ago[VIDEO]: Nollywood Actor Femi Branch Denied Leaving Access After Assaulting Crew Member

-

Headline5 days ago

Headline5 days agoTinubu Reunites Wike, Fubara, Rivers Lawmakers (PHOTOS)