Headline

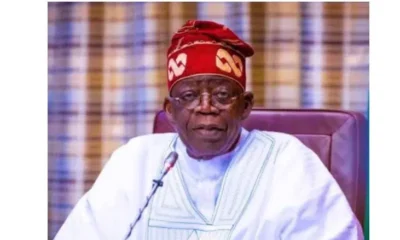

Tinubu Drops Tax Bombshell: 4 New Laws to Reshape Nigeria’s Economy

-

Brands and Marketing6 days ago

Brands and Marketing6 days agoSee Dollar To Naira Exchange Rate Today, November 28, 2025

-

Crime1 week ago

Crime1 week agoUK Rejects Nigeria’s Request To Transfer Ekweremadu’s Prison Sentence, See Why

-

Headline1 week ago

Headline1 week agoJUST IN: Tinubu Finally Appoints Ambassadors, See Full List

-

Headline6 days ago

Headline6 days agoBREAKING: El-Rufai Officially Joins ADC— Reports

-

Entertainment6 days ago

Entertainment6 days agoBurna Boy’s ‘No Sign Of Weakness’ U.S. Tour Dates Cancelled, See Why

-

Headline7 days ago

Headline7 days agoCAF Approves 28-Man Squads For 2025 AFCON, See Full List

-

Education1 week ago

Education1 week agoJUST IN: ASUU Alongside NEC Set To Review FG’s Negotiation, See Date

-

Headline1 week ago

Headline1 week agoBREAKING: 24 Kebbi Schoolgirls Kidnapped Regain Freedom

-

Headline1 week ago

Headline1 week agoBREAKING: Islamic Scholar Sheikh Dahiru Is Dead, See Details Of Burial

-

Brands and Marketing2 days ago

Brands and Marketing2 days agoUPDATED: See Naira To Dollar Exchange Rate Today