Brands and Marketing

Access Bank in trouble over customer relationship breach and more

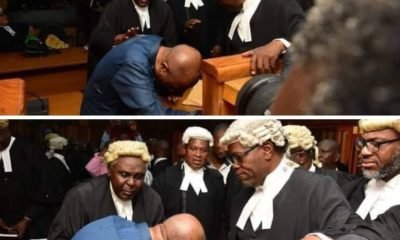

A Lagos court has ordered Access Bank to pay the sum of five (5) million for customer relationship breach.

OnyxNews Nigeria reports that Justice Ibironke Harrison of a Lagos High Court presiding in Igbosere, Lagos Island, has indicted and ordered Access Bank to pay the sum of five million naira to its customers, Blaid Construction Limited and Blaid Properties, for breach of bank-customer relationship.

Justice Harrison while delivering the judgment, declared that a post-no-debit, PND, alert action by the bank and continued denial of the customers’ rights to access and operate their accounts since 2015 were unlawful, illegal and void except within the periods between July and September, 2016.

The judge noted that the judgment was delivered outside of the 90-day period prescribed by the 1999 constitution due to the viral disease, coronavirus.

This online news platform understands that the case was laid against Access Bank, in May 2017.

The claimants’ statement of claim include a declaration that the post no debit alert and continued denial of the claimants’ right to access or operate their bank accounts is illegal and unlawful; an order directing the defendant to immediately remove and take down the post no debit alert placed on the account; N500 million damages for breach of bank-customer relationship; and costs of the actions.

The court noted that Access Bank filed its defense submission in June 2016 while the claimants filed a series of documents, including cheques, solicitors’ letters, among others.

Access Bank opened its suit on October 22, last year by calling its sole witness, Olugbenga Kutemi, the zonal head business banking division of the bank.

He adopted his statement on oath dated June 11th, 2019 and tendered two documents out of the six documents mentioned.

The court said that the post-no-debit alert placed on the claimants’ accounts was removed by the bank in December 2017.

The case was closed on January 14, 2020.

In its judgment, the court said the bank “unilaterally restrained” about seven accounts belonging to the claimants and placed post-no-debit alert on the accounts in September 2015 even though a letter by the Independent Corrupt Practices and Other Related Offences Commission (ICPC) letter only referred to two accounts.

The court noted also that the ICPC did not get any directive from a competent court authorizing the PND order, contrary to a prevailing law.

Also, while the Economic and Financial Crimes Commission, EFCC, obtained a valid order from a court, the order was to lapse in three months.

“Thus, from 30/9/2016 till the PND was lifted,” the court said, the claimants accounts were frozen without any court order.

The court also noted that when ICPC instructed the bank to lift the PND order, it failed to comply and a warrant of arrest was issued against the bank and its managing director.

In its defense submissions, Access bank noted that in obedience to the letter from ICPC, it was in the process of lifting the PND when another letter dated 9/11/17 from the special presidential investigation panel for the recovery of public property instructed them to place PND on the accounts and they were confused and had to seek the order of the federal attorney general over the conflicting directives.

But, the court, in its judgment, found that the bank is in breach of its banker-customer relationship.

The customer has equally suffered loss that does not require specific evidence, the judge added.

The court, thereafter, ordered the bank to pay N5 million to Blaid Construction Limited and Blaid Properties, also the PND order was illegal and unconstitutional.

-

Entertainment1 week ago

Entertainment1 week agoVideo: See What Ned Nwoko Did To Tiktoker Who Claimed His Wife, Regina Daniels Has A Boyfriend In Abuja, Sowore Slams

-

Crime5 days ago

Crime5 days agoBREAKING: Nigerian Man Arrested in U.S. Over Massive Fraud Scheme Targeting Veterans’ Health Organization(PHOTO)

-

Education5 days ago

Education5 days agoBREAKING: Lagos Launches Bold Move to Control Private and Mission Schools – New Policy to Shake Up Education Sector

-

Headline5 days ago

Headline5 days agoSenate Appoints Chibudom Nwuche, As Chairman Of South-South Development Commission

-

Crime6 days ago

Crime6 days agoBREAKING: Popular Nigerian Gospel Singer Sentenced To Death By Hanging

-

Headline5 days ago

Headline5 days agoHIJRAH 1447AH: Osun, Jigawa Govts Declare Friday Public Holiday

-

Headline1 week ago

Headline1 week agoPresident Tinubu Vows Justice for Plateau Wedding Guests Killed in Attack

-

Education5 days ago

Education5 days agoOutrage in Ibadan: Students, Alumni Kick Against Renaming of Ibadan Polytechnic After Late Governor Olunloyo

-

Entertainment1 week ago

Entertainment1 week ago[VIDEO]: Nollywood Actor Femi Branch Denied Leaving Access After Assaulting Crew Member

-

Headline5 days ago

Headline5 days agoTinubu Reunites Wike, Fubara, Rivers Lawmakers (PHOTOS)